Tobacco Tax Compliance

Tobacco tax software for cigarettes & other tobacco products

Is your tobacco tax compliance mostly manual, leaving you stuck in spreadsheet jail?

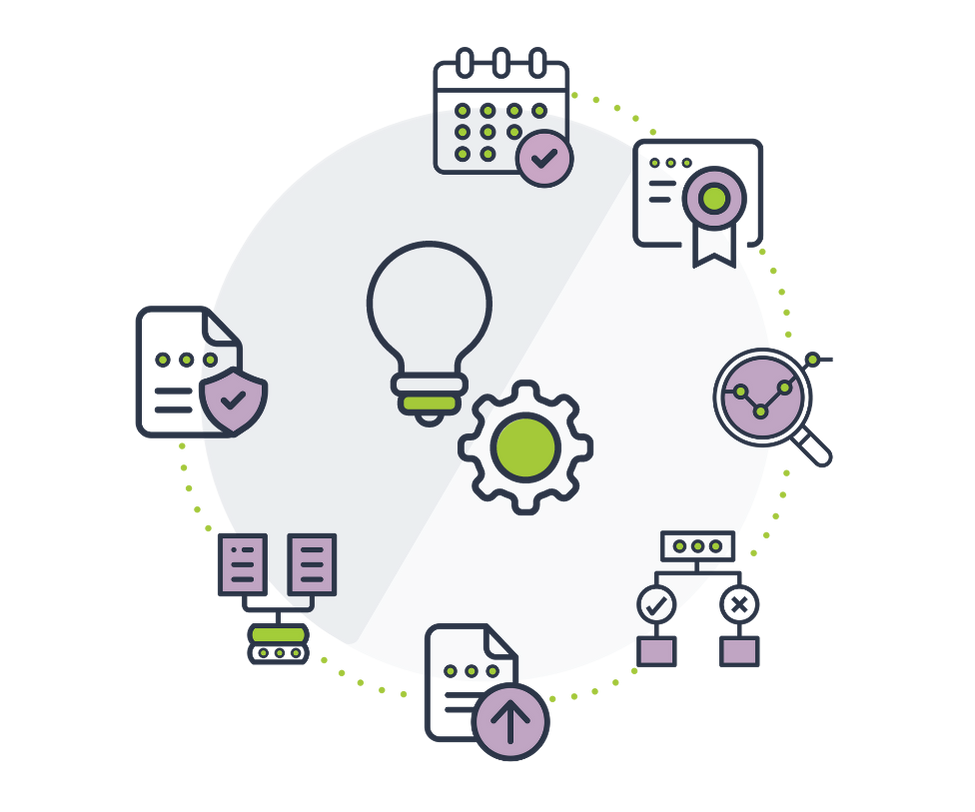

Skip the spreadsheets and seamlessly navigate the ever-changing tax landscape with the tobacco tax compliance platform that can save you up to 75% of your time!

Trusted by Industry Leaders

Join teams that reduce risk, save time, and increase accuracy in compliance. Read their stories here.

A New Way to Comply

Finally, a tobacco tax compliance platform that actually helps you reduce risk, minimize cost and elevate your tax team.

Download Now

Tobacco Excise Tax: Comprehensive Guide

Explore excise tax in the tobacco industry. Dive into the challenges tax teams face and how staying compliant impacts the day-to-day operations across the business.

State-by-state PACT report submission guidelines

We tracked down the PACT Act reporting information for each state. You’ll find a complete list of each state’s information, including Revenue/Taxation Agency by State, Attorney General by State, Reporting Method, and more!

Hiring tax talent: on-demand webinar

Our VP of Operations and Innovation, Nick Milledge, joins Sovos' Colleen Schlagel to discuss best practices in hiring tax talent and methods you can apply today:

- Impact of workforce fluctuations

- Retaining staff and the future of work

- Alternative recruiting and hiring methods

- Augmenting your team with technology

Digital transformation in tax compliance

Explore the move towards digital transformation in tax compliance, the challenges that come with automation, and discover how companies are: increasing efficiency, improving accuracy, reducing costs, maximizing the value of the tax team, and gaining a competitive edge in the industry for greater revenue.

2024 State Tax Changes in Tobacco & Vape

Access our comprehensive 2024 state tax changes report for an in-depth look at legislation affecting cigarette, tobacco, and vapor tax compliance this year.

Get Started

Talk to An Expert

To get started with ComplyIQ, powered by IGEN, simply fill out the form below or give us a call at 888.998.4436. Reach out to us today to talk to an expert.