C-Store Compliance

Tax compliance for convenience stores

Your complete tax compliance toolkit for c-stores, including taxes on fuels, tobacco, and vapor products. Get out of the weeds and get back to what matters most with the only platform that serves your business across the entire compliance lifecycle.

A New Way to Comply

Finally, a tax compliance platform that actually helps you reduce risk, minimize cost and elevate your tax team.

We know

Excise tax compliance for c-stores

Convenience store tax teams are challenged to do more with less while regulations increase rapidly, inaccuracies become more costly, and frequent consolidations in the market cause complexities. Meanwhile, hiring and retaining tax talent becomes more difficult and the knowledge gap grows.

You know

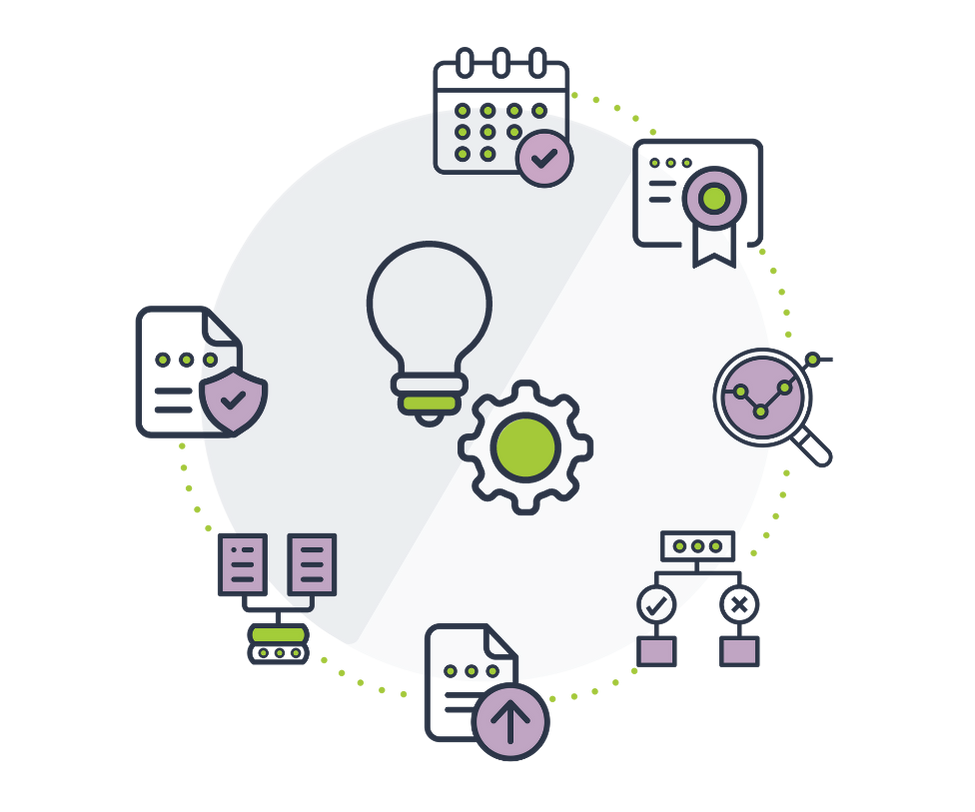

Tax compliance starts with accuracy & efficiency

Skip the spreadsheets and seamlessly navigate the ever-changing tax landscape. Our clients reduce their time spent on data preparation, tax rate research, and defending audits by up to 75%.

Download Now

Motor Fuel Excise Tax: Comprehensive Guide

Explore excise tax in the motor fuel industry. Dive into the challenges tax teams face and how staying compliant impacts the day-to-day operations across the business.

Tobacco and vape excise taxation: a comprehensive guide

Download our free guide and dive into the details of excise tax for tobacco and vapor products, why it can be challenging, and how it impacts the day-to-day business of tax teams.

Hiring tax talent: on-demand webinar

Our VP of Operations and Innovation, Nick Milledge, joins Sovos' Colleen Schlagel to discuss best practices in hiring tax talent and methods you can apply today:

- Impact of workforce fluctuations

- Retaining staff and the future of work

- Alternative recruiting and hiring methods

- Augmenting your team with technology

Digital transformation in tax compliance

Explore the move towards digital transformation in tax compliance, the challenges that come with automation, and discover how companies are: increasing efficiency, improving accuracy, reducing costs, maximizing the value of the tax team, and gaining a competitive edge in the industry for greater revenue.

Get Started

Talk to An Expert

To get started with ComplyIQ, powered by IGEN, simply fill out the form below or give us a call at 888.998.4436. Reach out to us today to talk to an expert.