Compliance Intelligence for Alcohol Companies

5/5 stars for client support

Managing your indirect tax compliance for alcohol shouldn’t feel like a hangover that drains your time and resources. For breweries, wineries, distilleries, wholesalers, and importers, the burden of state and federal filings, licenses, bonds, label renewals, and approvals is relentless, and the cost of mistakes is high.

ComplyIQ replaces static, manual processes with alcohol-specific compliance intelligence that tells your team what must be done, who must do it, and when.

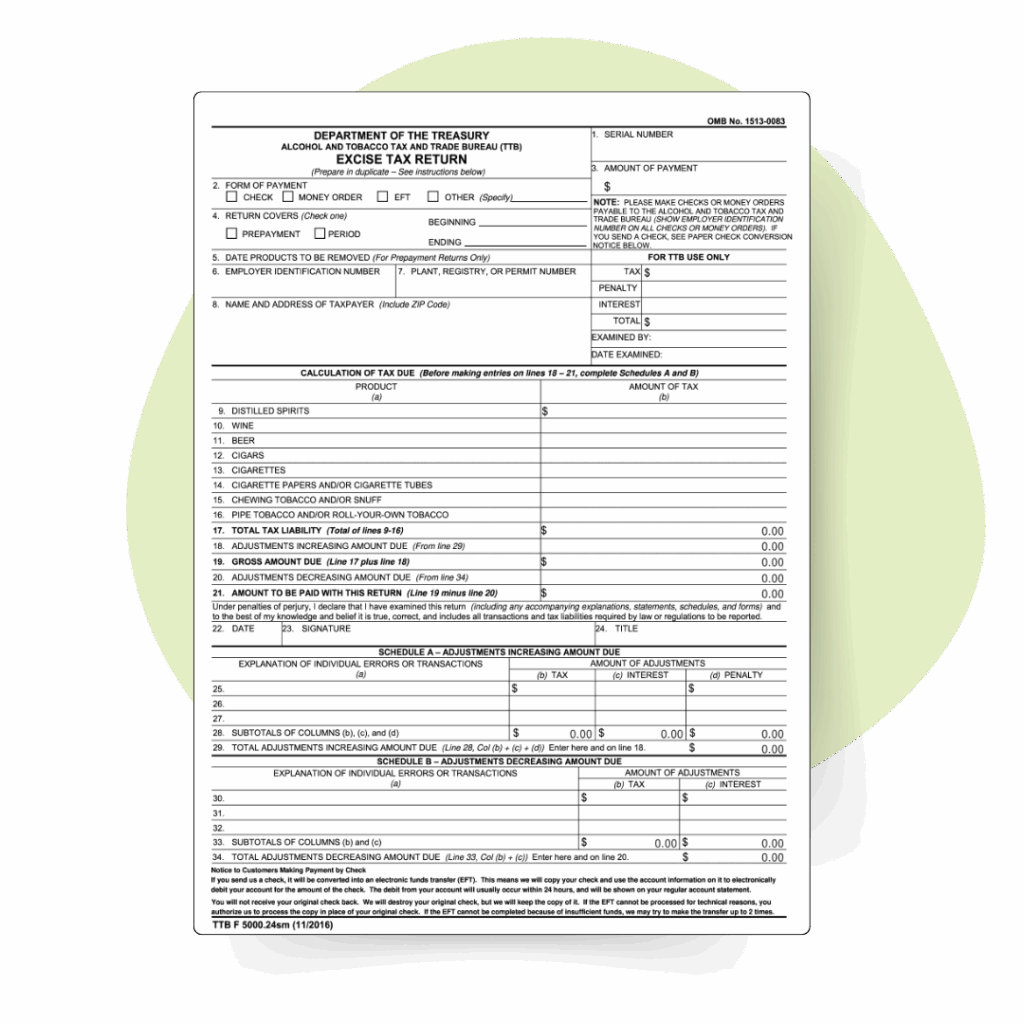

Comprehensive Indirect Tax Compliance Library

Stop wasting time researching what’s due, where, and when with ComplyIQ’s indirect tax library, maintained by subject matter experts.

Built for the Way Alcoholic Beverage Companies Actually Operate

Indirect Tax Compliance for Winerineries

As a dedicated indirect tax and compliance tracking tool, ComplyIQ monitors DTC and state wine filing obligation workflows. It provides clear visibility into license and bond obligations for all entities, including winery importers and distributors, with a real-time compliance dashboard.

Indirect Tax Compliance for Distilleries

Centralize oversight with ComplyIQ to actively monitor filing workflows across federal and state jurisdictions, providing clear visibility into license and bond obligations, and replaces static calendars with an intelligent, real-time dashboard.

Indirect Tax Compliance for Breweries

ComplyIQ provides a centralized view of all brewery filings and small brewer exemption certificates. It automates workflows tied to approval steps, reducing errors and keeping multi-state operations audit-ready.

Why Tax Leaders Love ComplyIQ

Risk Mitigation: Protect Your Bottom Line

Proactive Alerts:

Stay ahead of deadlines with automated notifications and escalating alerts to prevent fines, penalties, and interest.

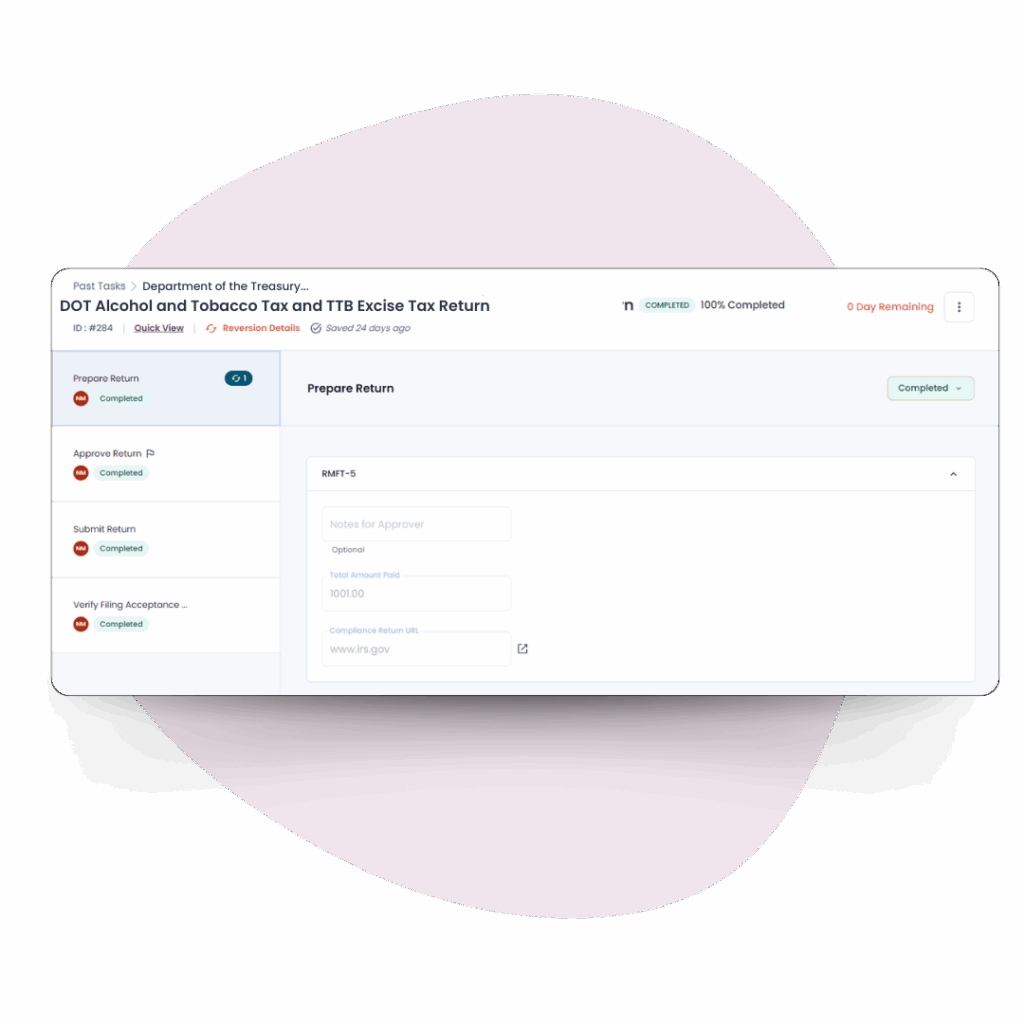

Audit-Ready Records:

Maintain a complete, traceable record of filings and approvals for seamless, disruption-free audits.

Compliance Logic Library:

Automatically adjust for jurisdiction-specific rules for agility and eliminate errors.

Task Reassignment:

Ensure no compliance step is missed during absences or turnover with seamless task reallocation.

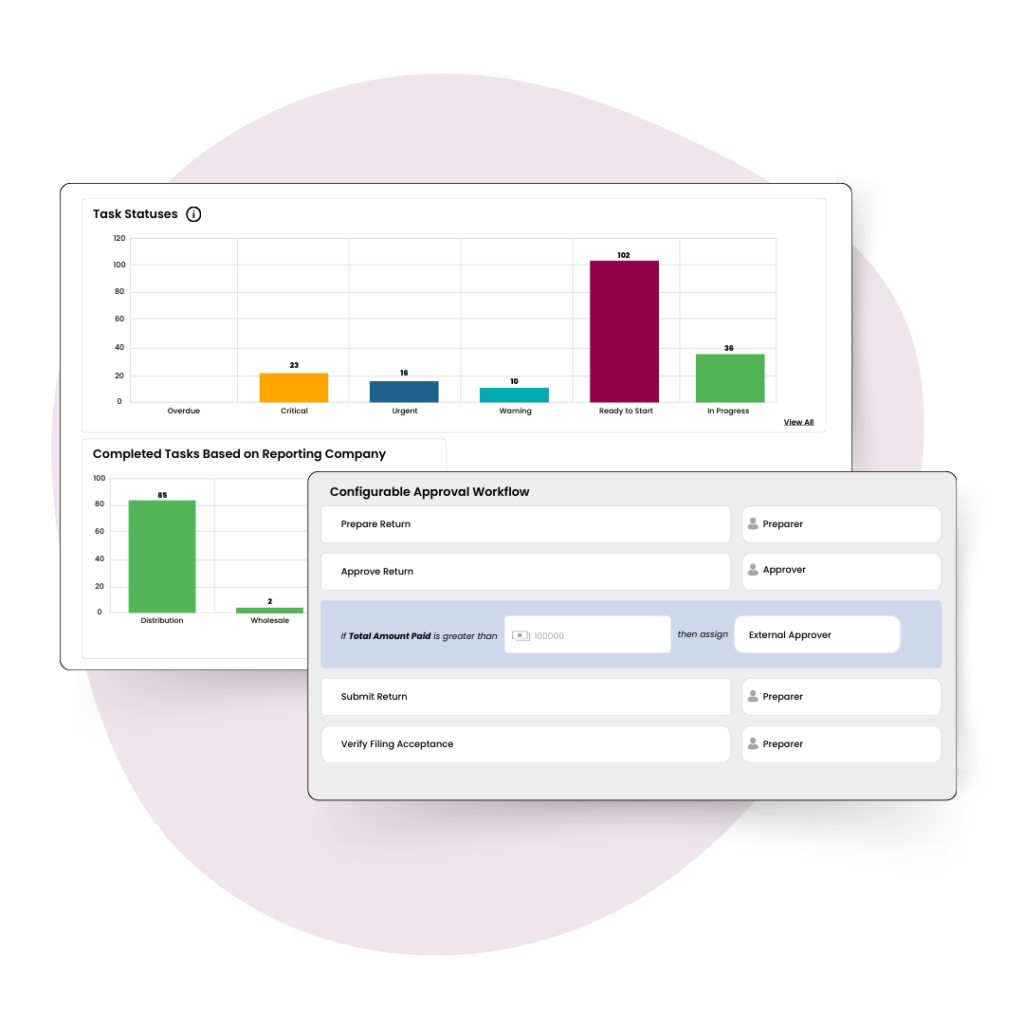

Real-Time Visibility: Gain Total Control

Centralized Dashboard: Gain a single source of truth for all filings, deadlines, and approvals.

Role-Based Visibility: Deliver tailored visibility to leadership, teams, and stakeholders for better decision-making.

Actionable Insights: Leverage performance metrics and risk assessments to address gaps before they become costly.

Operational Efficiency: Do More with Less

Automated Workflows: Replace manual processes with configurable workflows that streamline approvals and compliance tracking.

Eliminate Spreadsheets: Consolidate all compliance obligation tracking into one intelligent platform, reducing administrative overhead.

Free Up Resources: Shift high-value talent from repetitive tasks to strategic initiatives that drive growth.

Faster Onboarding: Get teams up and running quickly with minimal setup and intuitive tools.

Leverage Compliance Intelligence to Improve Tax Operations

Empower your alcohol business with IGEN’s compliance visibility and control, with IGEN. Talk with an expert today.